Ethereum Price Prediction: Can ETH Reach $4,000 Amid Market Turbulence?

#ETH

ArrayETH Price Prediction

Ethereum Technical Analysis: November 2025 Outlook

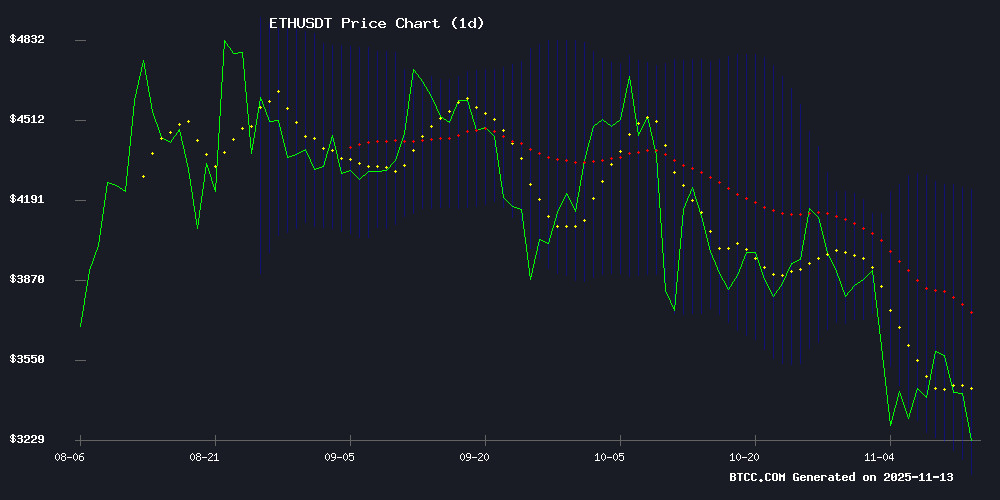

ETH is currently trading at $3,192.92, significantly below its 20-day moving average of $3,659.64, indicating bearish momentum in the short term. The MACD shows a positive histogram at 70.0781, suggesting some bullish divergence, but prices remain NEAR the lower Bollinger Band ($3,084.26), signaling potential oversold conditions.notes BTCC analyst Emma.

Ethereum Market Sentiment: Whales Accumulate Amid Volatility

Despite price weakness, on-chain activity reveals strategic accumulation by large holders. The ethereum Foundation's 'Trustlessness Manifesto' and institutional moves like BlackRock's $91M sell-off create mixed signals.observes BTCC's Emma. Notable Q3 revenue surges (1,100%) from ETH-centric strategies highlight real-world utility growth.

Factors Influencing ETH’s Price

Ethereum Whales Accumulate Billions in ETH Amid Market Dip

Ethereum's recent price correction to $3,000 has triggered aggressive accumulation by institutional players. A single entity acquired 385,000 ETH ($1.38 billion) within ten days, combining spot holdings with leveraged positions via Aave. The whale currently maintains $563.9 million in direct exposure and $818.7 million through borrowing strategies.

Parallel activity emerged as another whale collateralized 83,816 ETH ($288.6 million) to borrow $122.89 million in stablecoins, signaling conviction in ETH's rebound potential. BitMine notably joined the buying spree, adding 110,288 ETH to its corporate treasury last week.

Market observers interpret these moves as strategic positioning during weakness. 'When whales borrow against holdings during dips, it's rarely for short-term plays,' noted a blockchain analyst. The leveraged accumulation suggests expectations of structural demand catalysts ahead of Ethereum's protocol upgrades.

Ethereum Price Projected to Surpass $10K by 2030 Amid Surging Presales and Binance Listings

Ethereum (ETH) remains the cornerstone of decentralized finance, driving innovation across thousands of applications and Layer-2 solutions, particularly Coinbase’s Base network. As institutional adoption accelerates and markets rebound, ETH's price trajectory serves as a barometer for the broader crypto ecosystem. Analysts predict a rally to $4,000–$4,500 by November 2025, fueled by Layer-2 expansion and Ethereum’s deflationary post-upgrade model. Long-term bullish scenarios envision ETH breaching $10,000, with potential to reach $15,000+ should Web3 adoption and institutional inflows materialize.

Investors are diversifying into high-potential Binance listings and presales like Based Eggman (GGs), Bullzilla, and BlockchainFX—early bets on projects poised to shape the next market cycle. Key catalysts include regulatory clarity, traditional finance integration, and Ethereum’s enduring dominance as the backbone of blockchain infrastructure.

Vitalik Buterin Unveils Ethereum’s New Trustlessness Manifesto

Ethereum co-founder Vitalik Buterin, alongside researchers Yoav Weiss and Marissa Posner, has released the "Trustlessness Manifesto," a foundational document stored immutably on Ethereum's blockchain. The manifesto underscores Ethereum's core mission: enabling peer-to-peer cooperation without intermediaries while preserving user sovereignty and transparency.

The smart contract hosting the manifesto features a single function, pledge(), which timestamps user commitments on-chain. This design ensures permanent, verifiable participation in Ethereum's trustless ethos. Buterin warns against the creeping centralization that often accompanies convenience-focused development, urging builders to prioritize decentralization as a non-negotiable principle.

Canary Capital Files to Launch First U.S. Spot ETF for MOG Coin

Canary Capital Group LLC has submitted a groundbreaking filing with the SEC for a spot ETF tied to MOG Coin, marking the first-ever attempt to bring a memecoin into the regulated ETF space. The proposed Canary MOG ETF would hold the actual cryptocurrency, offering investors direct exposure to the asset's price movements.

The filing, dated November 12, 2025, represents a significant expansion of crypto investment products beyond the usual large-cap tokens. The trust plans to value its holdings daily using executed trades across major platforms, with custody handled by a chartered trust company.

Approval could dramatically increase MOG's market visibility and liquidity, potentially opening the floodgates for other community-driven tokens to enter the mainstream financial system. The move signals growing institutional willingness to engage with assets that originated as internet memes.

SharpLink Posts $104M Profit as ETH Treasury Strategy Pays Off

SharpLink Gaming (NASDAQ: SBET) reported a $104.3 million profit in Q3 2025, driven largely by its Ethereum treasury strategy. The firm now holds 861,000 ETH, doubling its ETH-per-share concentration since inception. Co-CEO Joseph Chalom emphasized disciplined risk management and yield-generating staking as key to their success.

The company plans to deploy $200 million into DeFi on Linea, further cementing its position as a pioneer among public companies leveraging Ethereum for financial growth. SharpLink's performance underscores the viability of crypto-driven treasury strategies in traditional corporate finance.

Ethereum Tests Key Support Levels Amid ETF Outflows and Network Upgrade

Ethereum's price dipped below $3,550, now hovering near critical support at $3,450. A breach could see it slide toward $3,300. Trading volume fell 18.54% to $32.74 billion, though weekly gains of 6.29% hint at residual bullish momentum.

The Fusaka Upgrade, slated for December 3, looms as a potential catalyst. Network modifications often trigger volatility—traders are positioning accordingly. Meanwhile, Ethereum ETFs bled $107 million in outflows, with all nine funds recording zero inflows. Total net assets stand at $22.48 billion, reflecting waning institutional appetite.

Technical indicators paint a conflicted picture. RSI sits neutrally at 45.14, while MACD signals bearish pressure. Resistance at $3,590 remains the line in the sand—a decisive break could propel ETH toward $3,640.

BlackRock Clients Execute $91 Million Ethereum Sale Amid Portfolio Rebalancing

BlackRock's institutional clients have offloaded 26,610 ETH worth $91 million via Coinbase Prime, marking one of the largest institutional Ethereum movements in recent weeks. The transactions, tracked by blockchain analysts, originated from BlackRock's Ethereum ETF address to Coinbase custody wallets.

Despite the divestment, BlackRock maintains a substantial $13.6 billion Ethereum position, holding 3.9 million ETH. Market observers interpret the move as routine portfolio reallocation rather than diminished confidence in Ethereum's outlook.

The sale follows contrasting flows in crypto ETFs - Bitcoin products saw inflows while Ethereum funds experienced outflows. Institutional investors appear to be reweighting digital asset exposures rather than exiting positions entirely.

Vitalik Buterin Highlights Ethereum's Role in Mature DeFi Ecosystem

Ethereum founder Vitalik Buterin has declared decentralized finance (DeFi) a viable global savings vehicle, marking a pivotal shift from its speculative origins. Advancements in Ethereum's security framework and layer-2 scaling solutions now enable faster, cheaper transactions while mitigating historical risks of protocol failures.

"DeFi as a form of savings is finally viable," Buterin asserted, emphasizing its growing adoption as a hedge against fiat system vulnerabilities. The ecosystem's maturation coincides with institutional interest in blockchain-based financial alternatives.

SharpLink Gaming's Ethereum Strategy Drives 1,100% Q3 Revenue Surge

SharpLink Gaming's bold pivot to Ethereum-focused treasury management has yielded staggering results. The company reported $10.8 million in Q3 2025 revenue—a 1,100% year-over-year increase—with net income swinging from an $885,000 loss to a $104.3 million profit.

Ethereum holdings now comprise 861,251 tokens, forming the backbone of a nearly $3 billion crypto asset portfolio. Strategic deployments include a $200 million allocation to ConsenSys' Linea network for DeFi yield generation, demonstrating institutional-grade crypto asset management.

The firm's $31.6 million share buyback signals strong conviction in its crypto-forward strategy. As traditional gaming companies explore blockchain integration, SharpLink's success may establish a blueprint for Web3 treasury management.

Ethereum Foundation and Vitalik Buterin Release 'Trustlessness Manifesto' On-Chain

The Ethereum Foundation, in collaboration with Vitalik Buterin, has unveiled a groundbreaking 'Trustlessness Manifesto,' cementing Ethereum's commitment to decentralized coordination. The document, permanently stored on-chain in an immutable, ownerless contract, emphasizes credible neutrality, self-custody, and verifiability over mere financial efficiency.

Its core function—pledge()—records adherents' addresses and timestamps, emitting an event that reinforces Ethereum's anti-fragile ethos. This move signals a philosophical pivot for the ecosystem, prioritizing censorship-resistant infrastructure amid growing institutional interest in blockchain's trust-minimizing potential.

Will ETH Price Hit 4000?

Our analysis suggests ETH faces strong resistance near $4,000 in the near term:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $3,192.92 | 23% below target |

| 20-Day MA | $3,659.64 | Key resistance level |

| Upper Bollinger | $4,235.02 | Volatility ceiling |

While whale accumulation and ecosystem developments are positive, Emma notes: "ETH would need to break through three technical barriers - the 20D MA, psychological $3,500 level, and 2025's descending trendline - making $4,000 unlikely before year-end without a major catalyst."

Moderate bearish short-term, bullish long-term